Tagged: points Toggle Comment Threads | Keyboard Shortcuts

-

-

Using CIC -> Gift Card -> Gift of College -> Student Loan Servicer

Using the Chase Ink Cash in this way nets 10k points for every $2,000 spent, resulting in $59.50 in fees. That’s in addition to the sign-up bonus.

For comparison, if the CIC was used directly through GoC, it would net 2k points for every $2,000 (515×3 + 455) spent, resulting in about $55 in fees. So it’s an extra 24k UR points.

(More …) -

I know that Amex gets a lot of hate here about how it has turned into a coupon book, but what’s more infuriating IMO is when they pull sneaky shit like they’re doing with their “Hilton” offer. I got an email yesterday about member week that highlights the Hilton offer, among other things. I have a Homewood suites stay coming up, and if I wasn’t on this sub, I would’ve rebooked it to take advantage of the offer. I wonder if Amex is prepared for the shit storm their CSRs are going to have to put up with when angry customers are going to reach out wondering why they didn’t get credited for this offer.

We are sorry sir, but that promotion only applies to Curio and Tapestry. Yes, sir. It is specified in the terms and conditions. Our advice is to always read your terms and conditions sir. Also you should check out the churning subreddit, they are a crowdsourced website and sometimes it can be helpful. Although sometimes you will get downvoted. It comes with the territory sir. We also sometimes check it out for new patterns of reward abuse. We are sorry that marketing didn’t do a better job at highlighting the limitations. Yes sir, I’ll convey your frustration to management. No, we cannot make exceptions to policy. Thank you for being a loyal American Express member since 2023 and have a nice day.

-

You have 30 dollars and 8 mouths to feed, what’s for dinner?

I’ll sign up for two Blue Apron plans at new subscriber promotional rates, which is currently $10 for 4 meals. For $20, we would have 8 meals spread across 4 menu choices, including shipping & taxes.

(More …) -

i also got an extra 150k. My rewards activity tab does not explain it. All I see is that my BBP got a 150k “adjustment” in 2023. (It shows up on the annual summary, to the right hand side on the website). Nowhere in the itemized rewards list does the 150k show up. It just showed up at some point in mid-July.

(More …) -

Citi Premier rejection after a 6-week review. It seems they were taken aback by the large number of inquiries and new cards but still wanted to look at it and requested tax records, but they saw that my AGI was much lower than reported in the application and rejected it.

-

I flew from LA to Las Vegas for a half day visit to match my Hyatt temporary Explorist status (provided as part of the Bilt challenge) to MGM Gold.

(More …) -

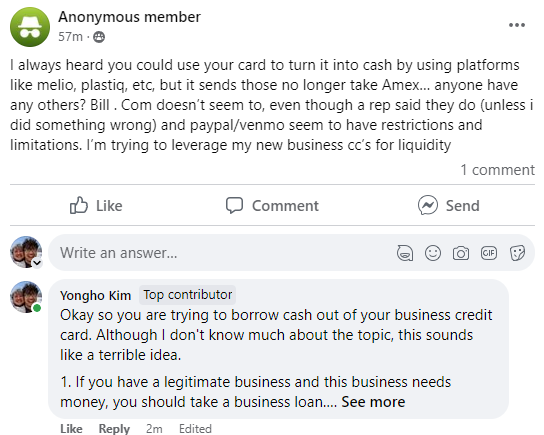

Okay so you are trying to borrow cash out of your business credit card. Although I don’t know much about the topic, this sounds like a terrible idea.

-

Something I spent way too much time typing up on a Facebook group:

Oh that’s a big misconception. The MasterCard Black is a problematic credit card product.

-

So in February I booked a one-way ticket from LAX to OGG for two at $400 on Hawaiian Airlines main cabin, through their website, in preparation for our honeymoon trip in September. I bought them in advance thinking that fares may go up later, and Hawaiian promised that main cabin tickets were fully refundable. I also moved 18,000 points to the Hawaiian account from Bilt, in anticipation for a return one-way ticket.

Their website flaunts this fact (that main cabin tickets are refundable) a lot.

“No change fees – Book now, change if you need to without a fee.”, the website says.

So it came time to cancel these flights. Our honenymoon plans changed.

I cannot cancel them online – I have to call.

(More …)

Reply