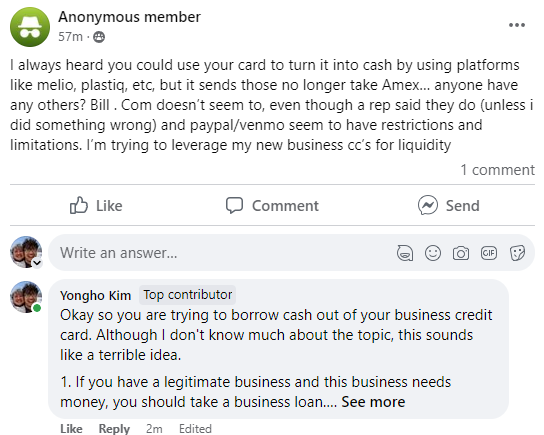

Okay so you are trying to borrow cash out of your business credit card. Although I don’t know much about the topic, this sounds like a terrible idea.

1. If you have a legitimate business and this business needs money, you should take a business loan.

2. If you want to borrow money out of your credit card’s credit line, you should use the credit card company’s cash advance feature, although that’s a bad idea because their interests are so high.

You are seeking some workaround that is neither of the above. Meaning you are trying to twist the program against the card’s Terms & Conditions.

That sounds like a sure way to get all of your accounts with that bank shut down if found.

The clean way that doesn’t break T&C and takes advantage of your credit card’s extended 0% APR rate would be to spend your regular, present/future purchases into that card, and ride on the 0% APR. Or do a balance transfer.

But you want to get cash out of it… oof.

Since you are dead set on breaking the bank’s T&C, why go the hard route? You could just use your business credit card to make a Paypal or Venmo payment to your friend, eat up the 3% transaction fee, and have your friend give you cash.

Lastly, I’m amused at how all you want to do is to borrow cash against a credit card’s credit line, which is a very simple concept, but instead of describing it as such, had to borrow fancy pansy tiktok finance bro jargon and describe it as “I’m trying to leverage my new business cc’s for liquidity”.

Reply